Table of Contents

A quick overview of e-invoicing

The world is increasingly digital, companies are transforming into e-commerce colossi, and the kingdom of Saudi Arabia has implemented global E-invoicing and E-Reporting norms.

The digital world is on the rise; e-commerce behemoths are proliferating. Governments are also increasingly using technology to reap the benefits of digitization, which is why they’re becoming more prevalent. The Saudi monarchy has also begun the process of moving to invoice software and e-reporting. Traditionally, invoices have been produced manually or digitally using a computer or other technology. The production of bills in a structured electronic format is known as electronic invoicing (e-Invoicing). A handwritten or scanned invoice is not an E-Invoice, either. E-Invoicing data are also not PDF or Word documents.

What is e-invoicing and how does it work?

E-invoicing, or electronic invoicing, is the process of issuing invoices through a digital or electronic format instead of a paper format. This helps to reduce fraud and ensure compliance with tax rules and regulations. It also helps to improve efficiency by allowing for the automatic matching of invoices with purchase orders and other documents related to the transaction. E-invoicing can be done through a variety of methods, including email, online portals, and even mobile apps.

Overview of KSA e-invoicing

E-invoicing is the future of tax compliance in Saudi Arabia. Starting on December 4th, 2021, all taxpayers (excluding non-resident taxpayers) and any other parties issuing tax invoices on behalf of suppliers subject to VAT will be required to issue invoice software through a compliant electronic solution that includes additional fields depending on the type of transaction. This will help reduce fraud and ensure compliance with taxation rules and regulations for both goods and services. Penalties for noncompliance include fines ranging from 5000 SAR to 25000 SAR depending on whether it’s related to VAT or not.

All e-invoicing suppliers must adhere to the e-invoicing regulations per their fiscal year or based on when their activity is recorded in the register of taxable persons by tax authorities.

Sales invoices are required for both goods and services, with an exemption made for financial services. Suppliers who do not provide invoice software may be penalized by law. Non-compliance may result in fines ranging from 5000 to 25000 SAR.

However, this regulation does not affect non-VAT-related transactions which continue to be issued as per previous regulations with no additional requirements except changing ‘ paper’ or ‘official’. However, tax invoice issuance will still include supplementary information such as code and Business Identification Code (BIC).

The second phase of the e-invoicing initiative, which will be enforceable as of December 4th, 2022, will include all taxpayers and any other parties issuing tax invoices on behalf of suppliers subject to VAT. This will require all invoicing software to be generated through a compliant electronic solution that meets the requirements of the Saudi Arabian General Authority for Zakat and Tax (GAZT) and included fields depending on the type of transaction.

Included in this phase is the requirement for invoice software to include a QR code that can be scanned by tax authorities to authenticate the invoice. This will help to reduce fraud and ensure compliance with tax rules and regulations.

To stay abreast of e-invoicing updates or learn more about e-invoicing solutions visit the Saudi Arabian General Authority for Zakat and Tax website at https://zatca.gov.sa/

E-invoicing problem and agitation

Problem: The e-invoicing initiative is a new regulation that will be enforced as of December 4th, 2021. This means all taxpayers (excluding non-resident taxpayers) and any other parties issuing tax invoices on behalf of suppliers subject to VAT will be required to issue e-invoices through a compliant electronic solution that includes additional fields depending on the type of transaction.

Agitate: E-invoice issuance will help reduce fraud and ensure compliance with taxation rules and regulations for both goods and services. Penalties for noncompliance include fines

In today’s world, it is always a good idea to have the best information on hand to help you run your business. This is especially true if you are in the auto repair industry. One of the major complaints from customers is that they find it hard to follow up with their auto repair shops.

Auto repair shop management software Cubtar

The good news is that there are a number of software solutions out there for this very purpose. Our auto repair shop management software – Cubtar, has developed an invoice software system that offers solutions for managing customers and their vehicles as well as invoicing and parts sales. In fact, one of its new features will support electronic invoices according to the requirements of the Saudi Income and Zakat Authority regulations in Saudi Arabia.

You can use your Cubtar account to create and send out an electronic invoice, follow up on your business, clients, and past bills, check the status of outstanding invoices, keep track of revenue received through transactions (including monthly revenue), integrate updates from the Saudi Zakat and Income Authority into the Cubtar system.

Send insurance companies electronic invoices

In addition to the potentiality to provide electronic invoice data to the Income and Zakat Authority and comply with regulations in the face of technical support 24 hours a day, 7 days a week, You can now send electronic invoices straight to the insurance company using emails.

Start today and do not hesitate because, with a free account at Cubtar, you can manage your auto repair shop and enjoy all of the exciting possibilities that will make you feel good about yourself. You’ll be able to acquire new leads and expand your customer base while still keeping your customers happy and engaged.

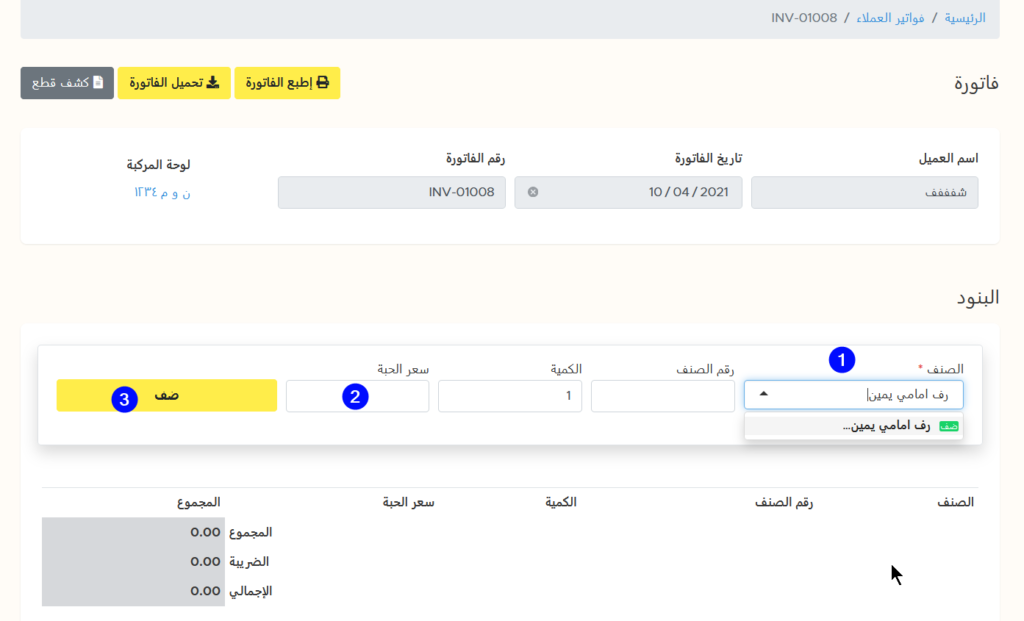

How to create car repair invoice form with Cubtar

Follow the steps with us

1- Open the car file by clicking on the new vehicle icon.

2- Click on “New Bill”

3- Verify the data and click on “New”

4- Add vehicle parts, components, quantity, and cost to the invoice.

5. You can now print the car repair invoice in accordance with the requirements for the electronic invoicing form of Saudi Zakat and Income Authority.

You can follow more updates on the auto repair invoice software Cubtar through our YouTube channel Cubtar for auto repair shop management

And follow the steps for issuing car repair invoices through the channel’s video

To find out more about how Cubtar contributes to the support and service of customers who own car service centers to achieve and follow up their profits, All of our competent professionals and experts are constantly ready to help you.

Please contact us at any time if you need assistance meeting all of your commercial requirements!